Crypto News from the Past Week: Bitcoin Faces Challenges as Durov's Legal Issues Stir Turmoil for Toncoin

In Brief

In late August, Bitcoin, Ethereum, and Toncoin encountered various hurdles in the market. This report delves into their recent performance and highlights the influences shaping their prices.

Bitcoin News & Macro

During the final week of August, Bitcoin struggled to stay above the critical $60,000 threshold, dragged down by a variety of market pressures. Its strong correlation with the Nasdaq 100 compounded the situation, pulling the cryptocurrency prices lower alongside traditional equity markets as month-end worries intensified.

Despite the launch of smaller-sized Bitcoin futures catering to retail investors by CME, there wasn't a notable spike in enthusiasm, as larger market forces continued to dictate trends.

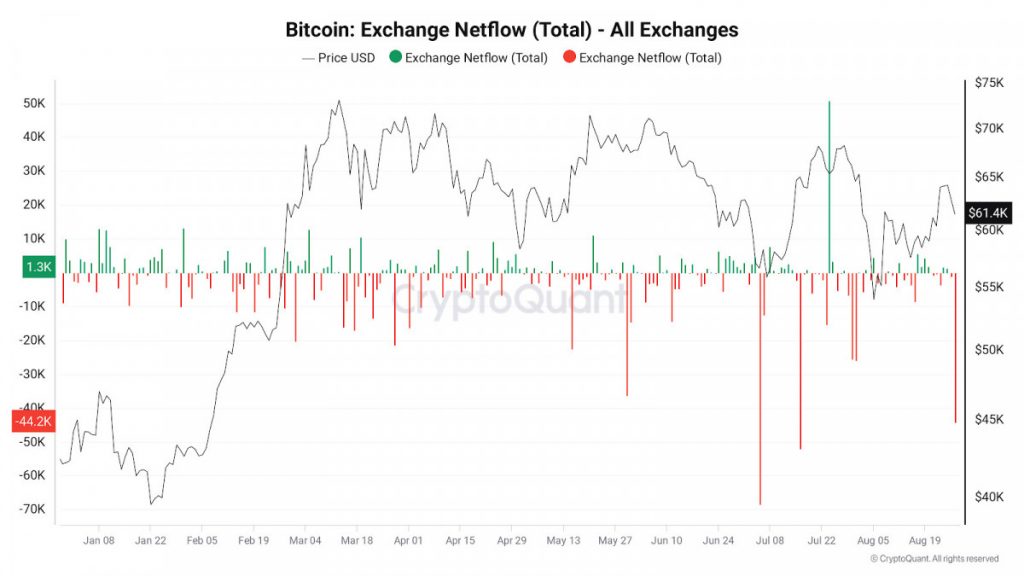

Amid rising anxiety, daily outflows from exchanges surged to their third-highest level this year, indicating that investors are opting to move BTC into private wallets instead of cashing out.

This shift reflects caution mingled with a strategic approach to holding assets, as many anticipate further price dips. Confidence in centralized exchanges waned, particularly after Binance faced allegations regarding the seizure of Palestinian crypto funds, escalating broader concerns about the safety of asset storage during turbulent market phases.

The market downturn, especially within AI and big data sectors — which have plummeted nearly 80% throughout the year — directly contributes to the prevailing unease, which, in turn, diminishes confidence in Bitcoin.

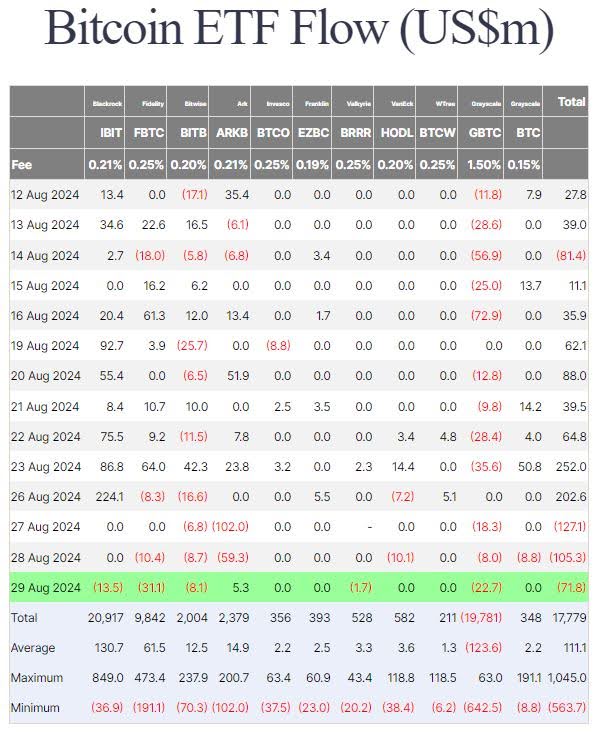

A decrease in institutional interest emerges as another setback, underscored by BlackRock’s Bitcoin ETF experiencing its largest outflow in over a month. While a few major players are capitalizing on price dips, overarching macroeconomic concerns, particularly regarding potential Fed rate hikes, loom large.

Meanwhile, the mining industry is feeling the strain as miners adapt to increasing operational costs, with the 2024 halving likely to tighten profit margins further. This increasing pressure on miners could lead to an even greater crunch in supply, adding complexity to Bitcoin's price movements.

BTC Price Analysis

When it comes to price fluctuations, Bitcoin's behavior at the end of August was both extreme yet subdued, plummeting from levels above $64,000 and breaking through critical supports with an aggressive impact.

This wasn’t just a typical downturn; intense selling pressure drove BTC down to the essential support level of $58,000, which has been crucial for several weeks. Bulls tried to rally above $60,000, but each effort was thwarted, especially around the 50-day EMA, transforming previous support into formidable resistance. Daily closes below these marks illustrate a narrative of sellers firmly in control, with $57,000 becoming the last barrier against further declines.

Examining the 4-hour chart, BTC appears caught in a bearish trend, wobbling between $58,000 and $59,000, unable to retake the 50 EMA. Every rebound attempt meets a barrage of sell orders, and bearish engulfing candles keep bullish aspirations in check. The RSI briefly dipped into the oversold zone, prompting some lackluster recoveries, but the overall bearish trend remains intact without a significant commitment from buyers. This market seems trapped, as every downward movement resembles distribution rather than accumulation.

The $57,000 mark is now pivotal. If breached, we could witness heightened selling pressure. Conversely, if $60,000 is reclaimed, that might shift the market's momentum, but the struggle at these crucial levels is intense. For the time being, bears maintain the upper hand, and bulls must exhibit substantial buying strength to alter the current dynamics.

Ethereum News & Macro

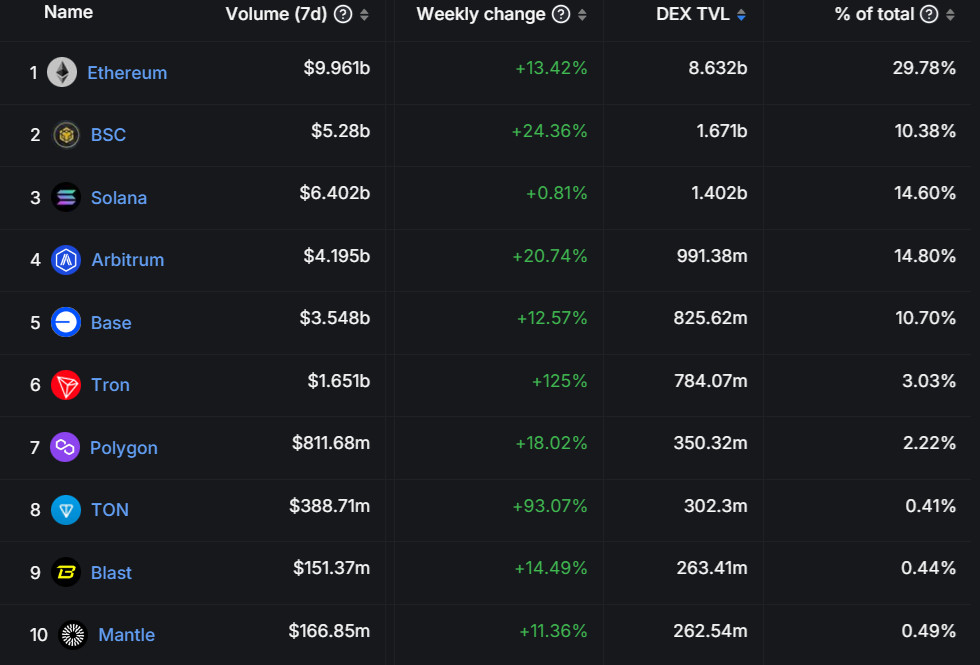

At the end of August, Ethereum also found itself amid turbulence. Despite a remarkable uptick in activity on Ethereum DApps — with a 36% leap in transactional volumes over the course of a week — the price of ETH has been unable to keep pace, revealing a growing gap between on-chain usage and market valuation.

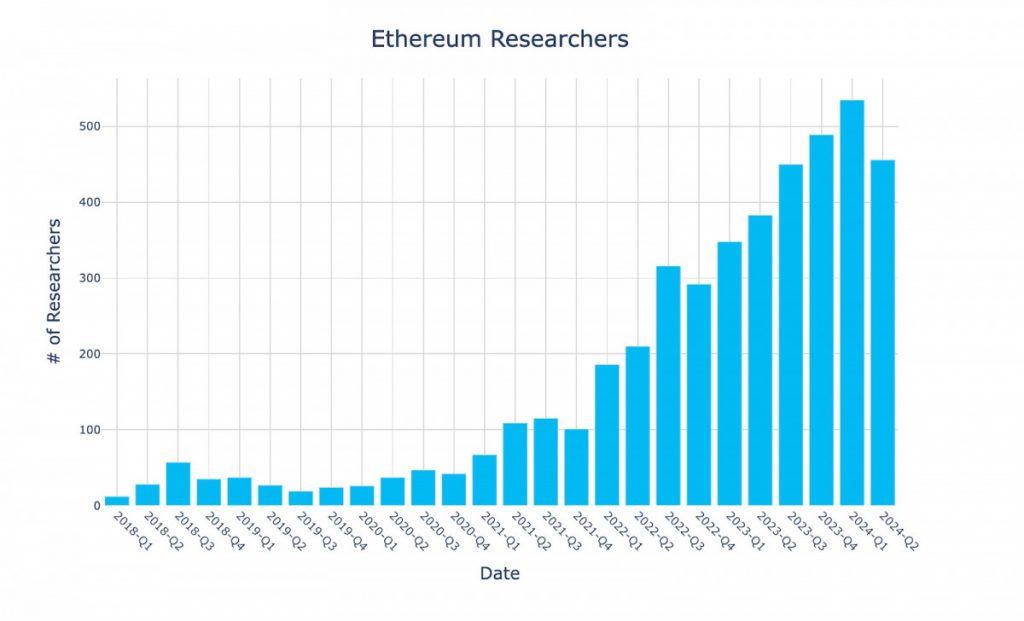

Staking has emerged as another focal point, as restaking activity surged while staking rates continued to dwindle, spurred by fierce competition among providers. Although this indicates robust ongoing interest in Ethereum staking, the diminishing yields are making it less appealing to some investors, resulting in reduced new capital inflows that could have supported price stability. Meanwhile, Ethereum's research scene is thriving, with team sizes skyrocketing over 2,100% since 2019 — a promising sign for long-term prospects, although it hasn't yet translated into immediate pricing benefits.

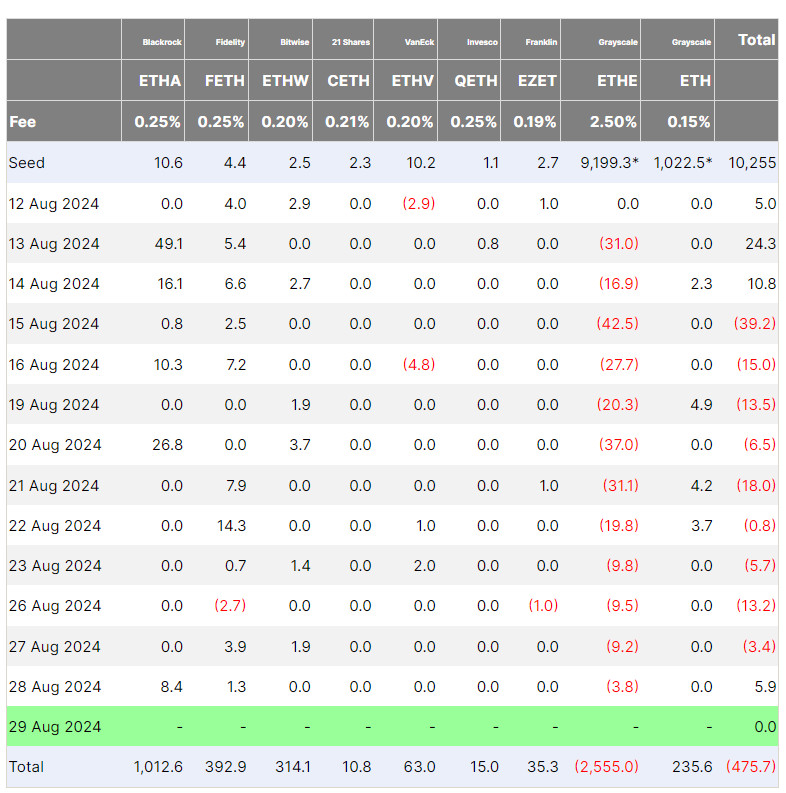

Institutional movements have been rather mixed. Recently, BlackRock’s Bitcoin ETF experienced its second-largest outflow, rattling nerves within the market and adding to the overall risk-off sentiment also weighing on Ethereum. On a positive note, Ether ETFs finally turned the tide, recording gains after two consecutive weeks in the red, suggesting a hint of resilience, though analysts caution that any significant breakout might still be delayed.

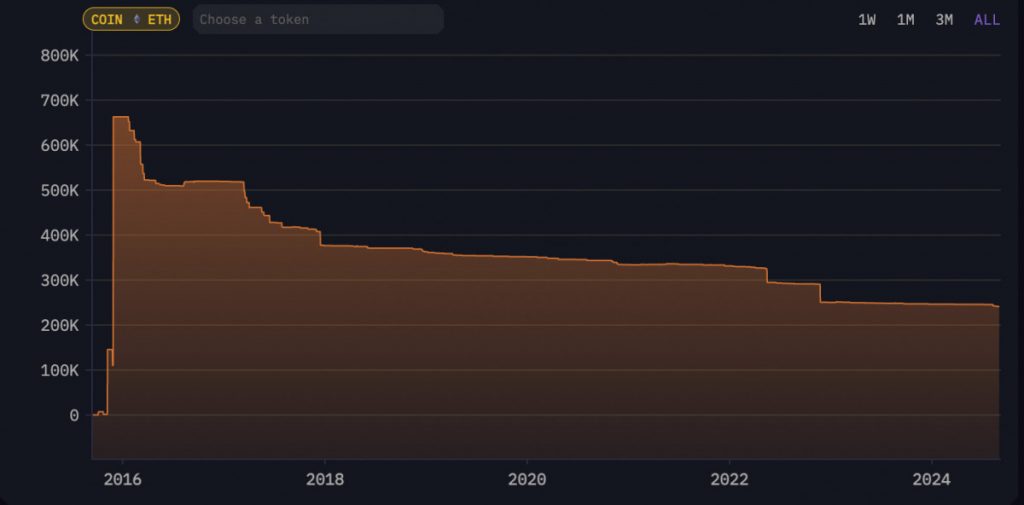

A notable event occurred when Vitalik Buterin executed a massive $10 million ETH transfer to exchanges, igniting speculation about potential selling pressure.

While Buterin affirmed he’s not liquidating and remains committed to Ethereum's long-term vision, his actions contributed to the already jittery market atmosphere among traders who are on high alert.

Consequently, market jitters and ongoing skepticism keep ETH at a standstill. For the moment, we find ourselves in a waiting game to see whether the fundamentals can finally provide the impetus to elevate the price.

ETH Price Analysis

Now, shifting our focus to technical analysis. Ethereum’s week commenced with a significant selloff on August 25th, plummeting from $2,600 to $2,450 in a swift move that sliced through support.

This breakdown underscored the dominance of sellers, with buyers largely absent from the scene. Attempts to stage a comeback have been weak, consistently thwarted by the 20 EMA at $2,621 and the 50 EMA at $2,819, both trending downward and acting as a ceiling on price. Last week’s closure below $2,500 set a bearish tone, indicative of weak consolidation which implies the market is catching its breath rather than gearing up for an upward move.

Analyzing the 4-hour chart reveals the aftermath of the crash — a descending channel that resembles a bear flag. Efforts to move higher have faced stern resistance at the 50 EMA around $2,559, showcasing the sellers’ continued grip on control. The RSI briefly entered the oversold territory but failed to mount a convincing recovery, reflecting the frail bullish momentum. The $2,500 mark is now a critical battlefield — dropping below it could trigger a drop to $2,400; conversely, maintaining above $2,550 may suggest a potential relief rally. Yet, for the time being, ETH remains trapped in a sideways pattern.

Toncoin News & Macro

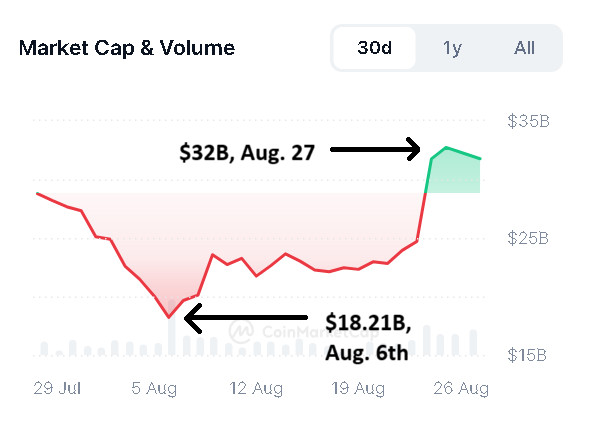

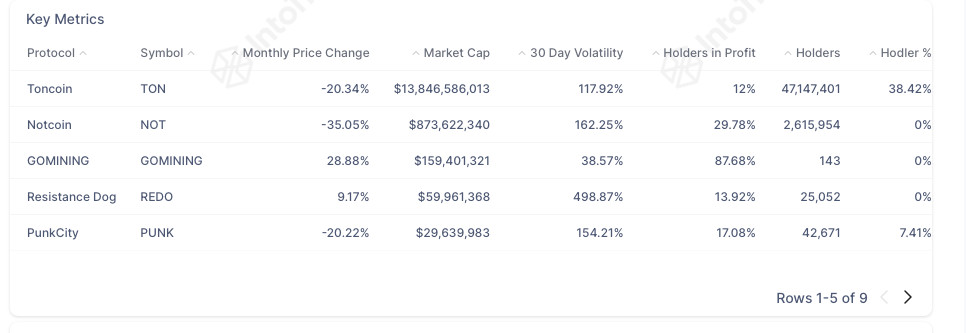

Now let’s take a glance at Toncoin. The recent arrest of Telegram CEO Pavel Durov sent tremors through the market, shaking investor confidence just as Toncoin was hitting an impressive $13.96 billion market capitalization.

Durov's legal challenges, which include travel bans and serious accusations, have cast a shadow over Toncoin, making traders skittish at any signs of instability within the broader Telegram ecosystem.

The Open Network (TON) didn’t manage to alleviate concerns either, experiencing several outages that amplified market anxiety. A surge in activity fueled by the memecoin DOGS temporarily took the network offline for 36 hours, resulting in inconsistent block production and raising fresh doubts about TON's capacity to accommodate spikes in demand.

These transaction disruptions eroded confidence in the network's reliability, despite reassurances from the TON Foundation that user assets remained safe. Such outages revealed notable vulnerabilities in TON's infrastructure, prompting traders to sell at the slightest indication of technical issues.

On a positive note, Toncoin's push into novel applications and the launch of Telegram-like mini DApps across platforms such as Line has showcased its growing ecosystem.

However, currently, these advancements are overshadowed by the persistent network instability and the unfolding legal challenges faced by Durov.

TON Price Analysis

It goes without saying that Toncoin’s price movements over the past week were significantly influenced by Durov’s arrest.

On the daily chart, the August selloff dropped TON below the vital $5.50 support level, triggering a downward trend under substantial selling pressure. Subsequent recovery attempts have been brief and ended without clearing the resistance near $5.60. The 20-day EMA still trails the 50-day EMA, highlighting bearish dominance, with lower highs indicating that sellers have the upper hand.

Delving into the 4-hour chart, we can see a brief spike in price following the Durov news, but it soon encountered solid resistance around $5.60. The bounce from the $5.20 support suggests some accumulation, yet the failure to breach the dashed resistance line indicates a market still grappling with uncertainty. The RSI has remained around neutral, mirroring indecision and a desire for strong directional momentum.

TON's price currently hovers just above the $5.20 support, with any break below likely to trigger heightened bearish sentiment. Should the price not hold this level, a descent towards $5.00 or lower could be imminent, reflecting the ongoing challenges facing the wider crypto market. On the other hand, convincingly reclaiming $5.60 could pave the way for a more substantial recovery, but given the prevailing sentiment, the future remains ambiguous.

Disclaimer

In line with the Trust Project guidelines It's essential to understand that the details shared on this site shouldn't be viewed as legal, tax, or financial guidance of any sort. Only invest what you can afford to lose, and if you're unsure about any financial decisions, seeking independent counsel is crucial. For more insights, please check the terms and conditions along with the support resources offered by the relevant issuer or advertiser. While MetaversePost strives for accurate and impartial news coverage, keep in mind that market dynamics can shift without prior notification.