This Week in Crypto: Bitcoin Faces Downward Pressure While Ethereum Struggles with ETF Hurdles

In Brief

Bitcoin has been grappling with bearish trends, while Ethereum encounters challenges in securing ETF approvals, and Toncoin's performance has been inconsistent amid market challenges.

Starting around September 2, Bitcoin attempted to recover, targeting the pivotal $60,000 mark as a base. However, market participants remained wary, focusing on potential interest rate cuts in the US, thereby maintaining a cautious 'wait-and-see' attitude.

Source: CryptoQuant

Investor anxiety was heightened by a decrease in active user addresses and a slowdown in institutional investment, indicating that many major players were taking a step back. Bitcoin's market direction appeared uncertain, with discussions of a possible drop to $40,000 gaining momentum. Miners also felt the pinch, as September recorded their lowest earnings streak in nearly a year, adding to the tense atmosphere in the market.

Source: Hashrateindex

As the week drew to a close, the bearish sentiment intensified. The market saw ETF withdrawals and significant sell-offs in the spot market, keeping the threat of downside risk palpable. Despite occasional attempts near the $60,000 mark, the market sentiment remained predominantly negative.

BTC Price Analysis

This past week, Bitcoin's price movements resembled a tug-of-war between optimistic buyers and aggressive sellers. On the daily chart, BTC fell below the critical $58,000 threshold early on, transforming what was once a support level into a daunting resistance point. The blue zone reflects the selling pressure, as every attempted rebound encountered strong resistance, with a sharp plunge below $55,000 setting a bearish tone for the week.

Source: TradingView

The 4-hour chart further clarified the downward trend: a series of consistently lower highs and lows, with the 50-EMA acting as a ceiling. The RSI hovered near oversold levels, indicating bearish domination, yet there were signs of exhaustion. Efforts to reclaim significant support levels like $54,000 were feeble, showcasing a market reluctant to engage amid fears of deeper declines.

Source: TradingView

The $54,000 mark has become a crucial battleground; losing it could result in a deeper slide for BTC, whereas reclaiming it might rekindle a push towards $56,000. For the time being, the charts convey a strong message of caution as traders prepare for potential further downturns.

Ethereum News & Macro

A notable narrative this week is Ethereum's tumble, as it slid into the red for 2024, shedding 42% of its gains amid broader market sell-offs. The bearish sentiment isn't solely attributed to macroeconomic challenges; regulatory uncertainties have also exacerbated the situation.

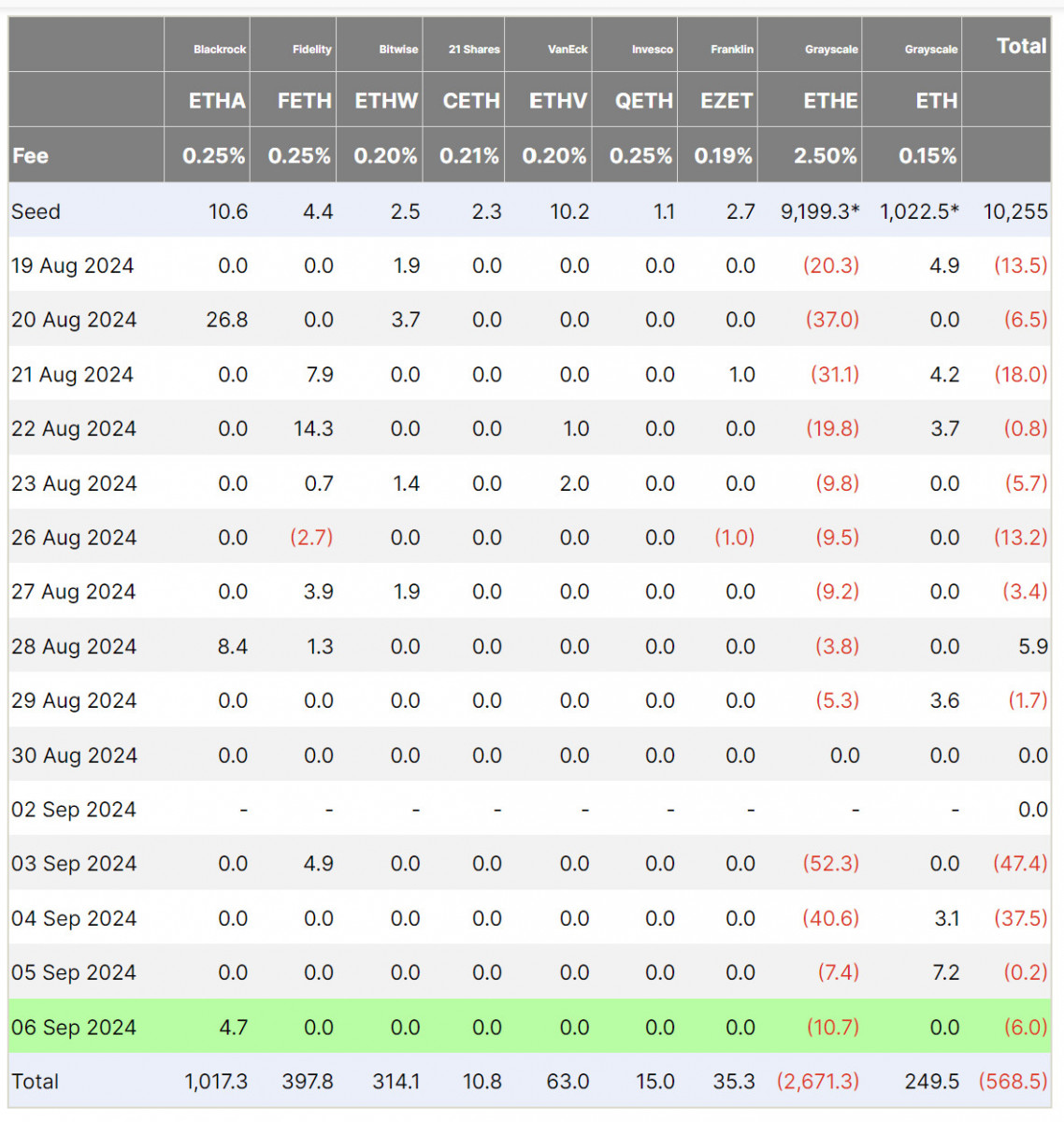

Source: farside.co.uk

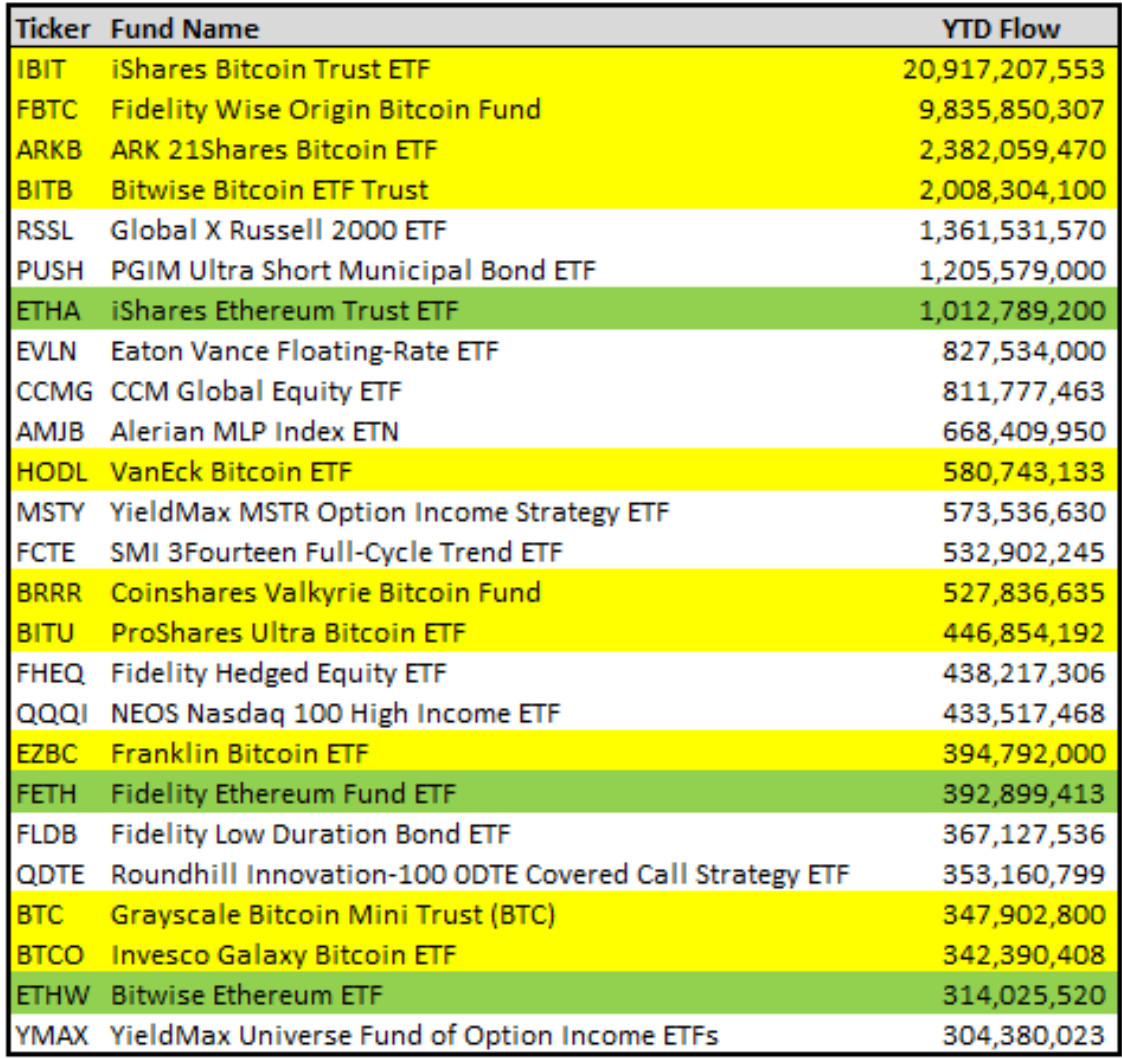

On September 7, WisdomTree made headlines by retracting its Ethereum spot ETF application with the SEC due to concerns about fees being categorized as a 'future use' issue. This withdrawal dampened hopes for a swift influx of institutional money, highlighting the ongoing regulatory ambiguities that continue to unsettle investors.

Source: The ETF Store

WisdomTree isn't alone—VanEck also opted to close its Ethereum futures ETF, reflecting tepid interest from institutional investors toward futures-based options while attention shifts to spot markets.

Source: Token Terminal

To add to these worries, Ethereum's Layer-1 network revenue has plummeted. Despite an increase in daily users and transaction volumes, figures from Token Terminal reveal that network revenue has halved since March, illustrating that high activity does not necessarily equate to increased revenue.

There were moments of technological optimism, such as Movement Labs enhancing Ethereum's capabilities to handle 12,000 transactions per second on its testnet. While this is indeed an impressive benchmark, it has done little to elevate market morale in the immediate term. The prevailing sentiment among traders focuses on immediate price impacts, seemingly overlooking potential long-term advancements.

ETH Price Analysis

Throughout the past week, Ethereum's price struggled under substantial bearish pressure. The daily chart showed ETH breaking down from the $2,480 support level, a critical threshold that held for several weeks, confirming the dominance of sellers. The 20-EMA displays a sharp downward slope, emphasizing the bearish trend, while the 50-EMA lingers above, weighing down any recovery attempts.

Source: TradingView

On the 4-hour chart, ETH remains trapped within a bearish channel, defined by lower highs and lows. Brief recoveries have been capped around $2,440—once a strong support, now acting as stubborn resistance. The RSI resides in bearish territory, indicating a lack of substantial buying interest. A bearish flag is evident, suggesting a potential continuation lower unless buyers step up.

Source: TradingView

With a backdrop of regulatory hurdles and ETF withdrawals, market sentiment stays cautious. Reclaiming crucial levels like $2,480 is key for altering the current narrative, but until that happens, the market feels stagnant, with sellers firmly in control.

Toncoin News & Macro

This week, TON has captivated attention with significant movements, hinting at potential shifts in market dynamics.

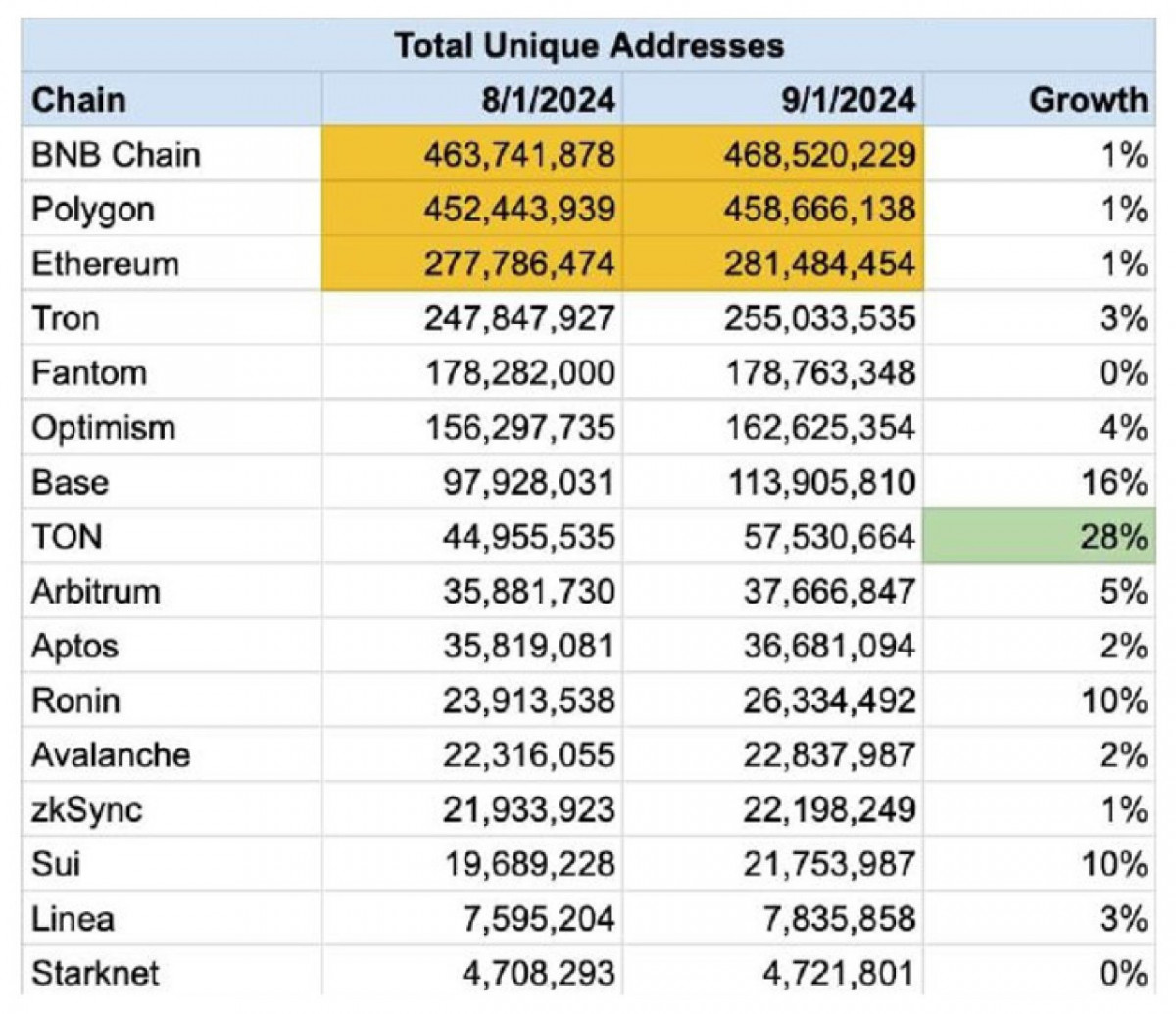

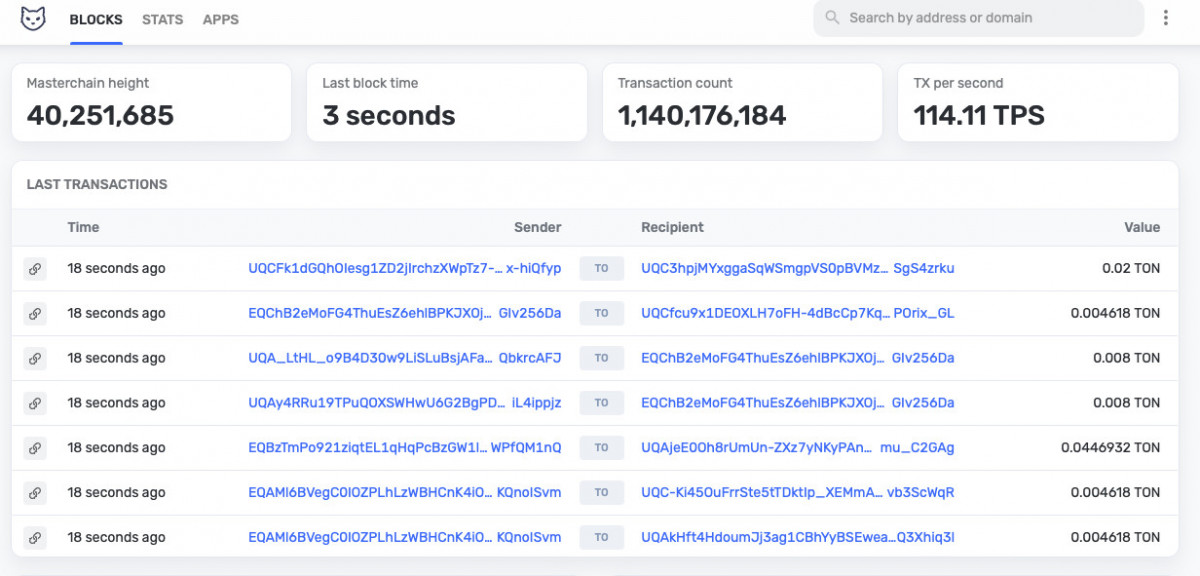

The network surpassed its rivals in gaining unique addresses, achieving a remarkable 28% growth within just a month, adding 12.5 million new addresses and leaving Ethereum, Polygon, and BNB Chain in its wake. This surge in user interaction coincided with TON crossing the 1 billion transaction benchmark, with half of these occurring in the past three months, showcasing the network's accelerating activity.

Source: Tronscan

In terms of investments, TON announced a new accelerator program, offering up to $2.5 million each for five exceptional projects. This initiative aims to stimulate innovation and attract new talent to the ecosystem. Additionally, the TON Foundation invested an extra $24 million into DeFi projects, which is aimed at expanding its influence and drawing more liquidity into its decentralized finance sector.

Meanwhile, ongoing developments involving Durov add an element of drama. French authorities have raised concerns that Telegram's lack of oversight has made it a hotspot for criminal activity. Although Durov has been released on bail, he remains prohibited from leaving France until further notice.

TON Price Analysis

Now, let’s turn our attention to TON’s recent price movements. On the daily chart, TON has been trending downwards, breaking below the $6.00 support level due to intense selling pressure, confining it to a narrow range between $4.60 and $4.90. The 20-day and 50-day EMAs are inclined downwards, putting a ceiling on any attempts to rebound and clearly reinforcing the prevailing downtrend. The latest price shifts have been rather subdued—small-bodied candles suggest uncertainty and some quiet accumulation, although there hasn't been the volume surge necessary for a genuine reversal.

Source: TradingView

Shifting to the 4-hour chart, the bearish sentiment continues to dominate. Prices are repeatedly rejected at key resistance levels around $5.50, with the 50 EMA acting as a steadfast barrier. Even when the RSI dips into oversold territory and triggers a brief recovery, those movements quickly lose momentum. Recent activity around the $4.90-$5.00 range indicates a potential pause, implying that sellers might be taking a breather, yet the broader downtrend persists. Overhead resistance remains significant, and any rally attempts will need to overcome that substantial selling pressure.

Source: TradingView

TON is at a pivotal point right now. Should it breach resistance near $5.50, there could be a chance for upward momentum; however, for the moment, the bears continue to hold sway.

Disclaimer

In line with the Trust Project guidelines Please keep in mind that the information presented on this page is not meant to serve as legal, tax, investment, financial, or any other type of advice. It’s crucial to invest only what you can afford to lose and to seek independent financial counsel if you have any uncertainties. For further details, we encourage you to refer to the terms and conditions and the support sections provided by the issuer or advertiser. MetaversePost is dedicated to delivering accurate and unbiased reporting, but market conditions are subject to change without notice.