India Rises to Claim the Title of the World's Second-Largest Market for Cryptocurrencies

In Brief

India has surged ahead to become the second-largest crypto market worldwide, facilitating approximately $268.9 billion worth of transactions between July 2022 and July 2023, even amidst steep tax rates.

The Central & Southern Asia and Oceania (CSAO) region has become a focal point in the global cryptocurrency scene, featuring in recent reports that underline growth. India As the second-largest market by volume, India is estimated to conduct transactions worth $268.9 billion.

However, these impressive statistics tell only part of the story; this region is also witnessing significant grassroots adoption. While high tax rates in India and regulatory challenges in Hong Kong have posed hurdles, the sector continues to thrive.

The Indian Enigma: Elevated Taxes Yet Rising Adoption

In an interesting twist, the steep tax rates in India have not suppressed the overwhelming interest and demand for cryptocurrencies. The government applies a hefty 30% tax on crypto profits and a 1% charge on all transactions.

India’s crypto landscape is not solely defined by transaction volume; it also excels in decentralized exchanges, centralized exchanges, lending protocols, and NFT platforms. Despite the uneven enforcement of transaction taxes leading to obstacles for local exchanges, the enthusiasm within the market remains undeterred.

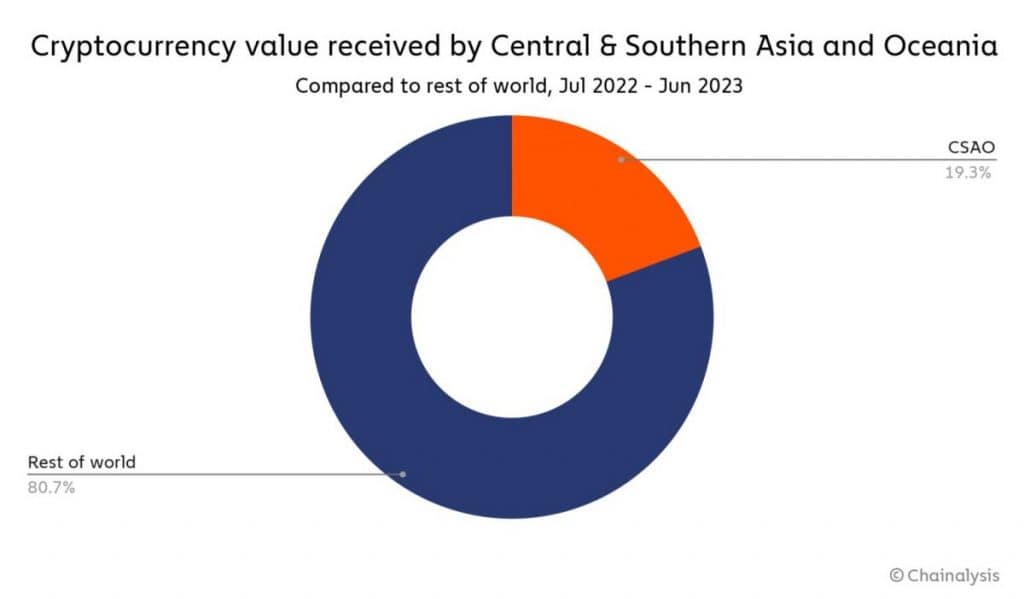

According to Chainalysis’ 2023 Geography of Cryptocurrency Report, CSAO accounts for nearly 20% of global crypto activities. Within this region, six nations—including India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand—rank on the Global Crypto Adoption Index, and a noticeable increase in DeFi activities points to a maturing market. The Philippine Trend: Embracing Play-to-Earn Models

The Philippines has gained attention for its openness to play-to-earn gaming platforms, particularly during the COVID-19 pandemic. This surge in gaming has catalyzed a wider acceptance of cryptocurrency, creating a foundation for advanced applications of digital assets.

Additionally, the nation is taking advantage of regulatory sandboxes and initiatives from the private sector, setting the stage for what could be regarded as the 'blockchain capital of Asia.' Axie Infinity, While the Philippines is heavily inclined towards gaming and speculative investments, Pakistan's adoption of cryptocurrencies primarily stems from economic necessity. Amid soaring inflation, many locals are turning to cryptocurrencies, particularly stablecoins, as a safeguard against economic turmoil. Even though trading is banned at present, there are indications that the government may be exploring regulatory frameworks that would legitimize crypto usage further.

Navigating Regulatory Challenges and Future Opportunities

The recent JPEX rug pull incident in Hong Kong has amplified calls for more stringent regulations and enhanced investor education.

Stakeholders are wrestling with the challenge of crafting regulations that foster innovation while ensuring investor protection.

CSAO is far from uniform; it represents a diverse landscape with differing rates of adoption and regulatory environments. Nonetheless, it provides valuable insights into how various economic and social factors influence the use of cryptocurrencies. Authorities across CSAO Whether it’s the gaming enthusiasm in the Philippines or the financial necessity in Pakistan, CSAO illustrates the myriad ways in which cryptocurrency can adapt to local circumstances and conditions, thereby reinforcing its role in future financial ecosystems.

Please be aware that the information shared on this page is not meant to provide, and should not be construed as providing, legal, tax, investment, financial, or similar advice. It’s essential to only invest what you can afford to lose and to seek independent financial guidance if you have uncertainties. For further details, we recommend consulting the terms and conditions and the help and support resources available from the issuer or advertiser. MetaversePost strives for accuracy and impartial reporting, but market conditions may change without prior notice.

Nik is a seasoned analyst and writer at Metaverse Post, focusing on delivering cutting-edge insights into the rapidly evolving tech landscape, especially in areas such as AI/ML, XR, VR, blockchain analytics, and development. His articles are designed to engage and inform a wide audience, keeping them at the forefront of technological advancements. With a Master's degree in Economics and Management, Nik possesses a nuanced understanding of the business world and its intersection with emerging technologies.

Disclaimer

In line with the Trust Project guidelines Blum Marks Its First Anniversary With Awards for ‘Best GameFi App’ and ‘Best Trading App’ at the 2025 Blockchain Forum