As we delve into the second week of 2025, Bitcoin is standing its ground at the $95,000 mark, Ethereum is eagerly anticipating the Pectra update, and Toncoin is wrestling with crucial support levels.

In Brief

Bitcoin (BTC)

The second week of January 2025 has wrapped up, providing a compelling glimpse into the crypto marketplace's evolution so far. The week began on an exhilarating note as Bitcoin reclaimed the $100,000 milestone on January 6.

BTC/USD 1D Chart, Coinbase. Source: TradingView

This surge rekindled enthusiasm among market participants, especially with notable institutional activity following suit. MicroStrategy has revealed plans to ramp up its Bitcoin acquisitions, while inflows into spot ETFs have been steadily rising. For a fleeting moment, the market appeared ready to ride the momentum to new heights.

Source: Michael Saylor

However, the bullish momentum proved to be short-lived, as rising Treasury yields and unexpectedly robust U.S. economic indicators cooled the market's fervor.

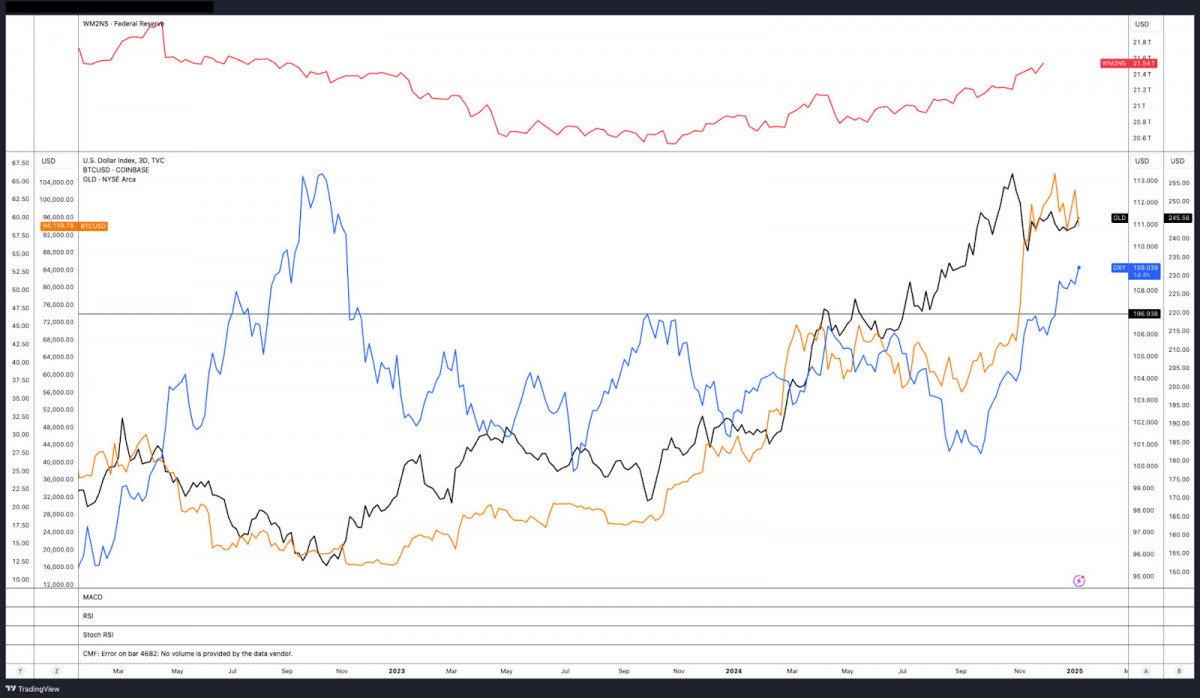

DXY vs BTC 3-day chart. Source: TradingView

By midweek, Bitcoin had dipped below the $95,000 mark and even tested $92,000, which rattled investor confidence and raised speculation about the possibility of a more extensive correction. There are also concerns about how the incoming Trump administration might influence Federal Reserve policies, potentially affecting Bitcoin's trajectory in 2025 negatively.

Despite the downturn, there is still a glimmer of hope. Market whales and institutions have been quietly accumulating Bitcoin at these lower levels, suggesting that interest in BTC remains intact.

Bitcoin seven-day balance change has flipped positive after a nearly 80,000 BTC sell-off in late December. Source: CryptoQuant

Analysts are divided on the market's future direction. While some interpret this as a classic 'buy the dip' opportunity, others caution that macroeconomic headwinds, notably rising yields and a strengthening dollar, could keep Bitcoin under pressure for the foreseeable future.

BTC/USD 4H Chart, Coinbase. Source: TradingView

Consequently, the overarching scene appears to be a balancing act between short-term uncertainties and long-term positive outlooks. With institutions actively participating, stable inflows into spot ETFs, and the significant psychological barrier of $100,000 back in focus, there’s a feeling that the market could be gearing up for another major shift.

Ethereum (ETH)

Ethereum (ETH) has also experienced a tumultuous week, with significant activity both behind the scenes and amid market fluctuations.

Source: Binance

The attention surrounding the Pectra upgrade is palpable — this update promises to enhance the network’s speed and efficiency, generating considerable excitement. Coupled with a pro-crypto administration in the U.S. and increasing ETF adoption, some analysts believe ETH is on the verge of a significant breakout this year.

ETH/USD 1D Chart, Coinbase. Source: TradingView

However, the price has not quite cooperated. Since Bitcoin's drop from $100,000 on January 8—the event that sent shockwaves through the market—ETH has been on a declining trend. Currently, it's hovering around $3,174, just above its recent lows, with its 50-day moving average stationed notably higher at $3,569, indicating the depth of its losses.

ETH/USD 4H Chart, Coinbase. Source: TradingView

The 4-hour analysis doesn't reveal much improvement either, as it indicates a gradual slide following a phase of consolidation. The RSI remains within oversold territory at 32, which might hint at a brief rally — but the broader sentiment still feels rather bearish.

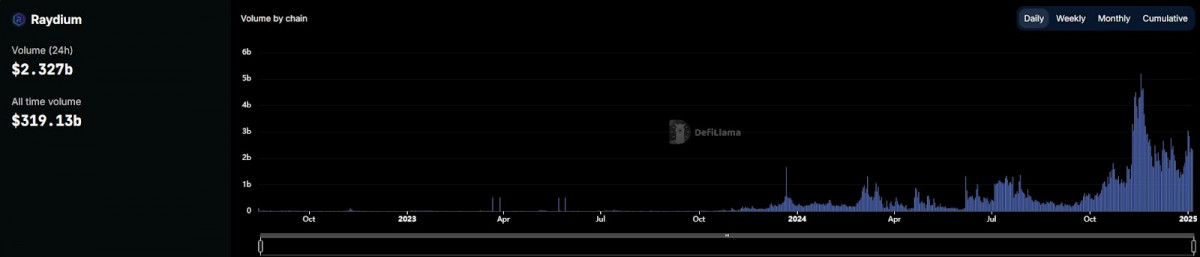

Raydium trading volume. Source: DefiLlama

On another front, Solana’s achievements have caught the eye, as its DEX trading volume has surged past Ethereum’s for the first time. This serves as a reminder that Ethereum's stronghold in DeFi is not guaranteed. Nonetheless, Ethereum's ecosystem still boasts its successes; for example, Ripple is set to integrate Chainlink price feeds into Ethereum, reaffirming its central role in the DeFi sphere amidst circling competitors.

Overall, the sentiment surrounding ETH is a blend of caution and possibility. While recent price movements have been challenging, there's a prevailing sense that ETH could yield surprises in the long run.

TON (Toncoin)

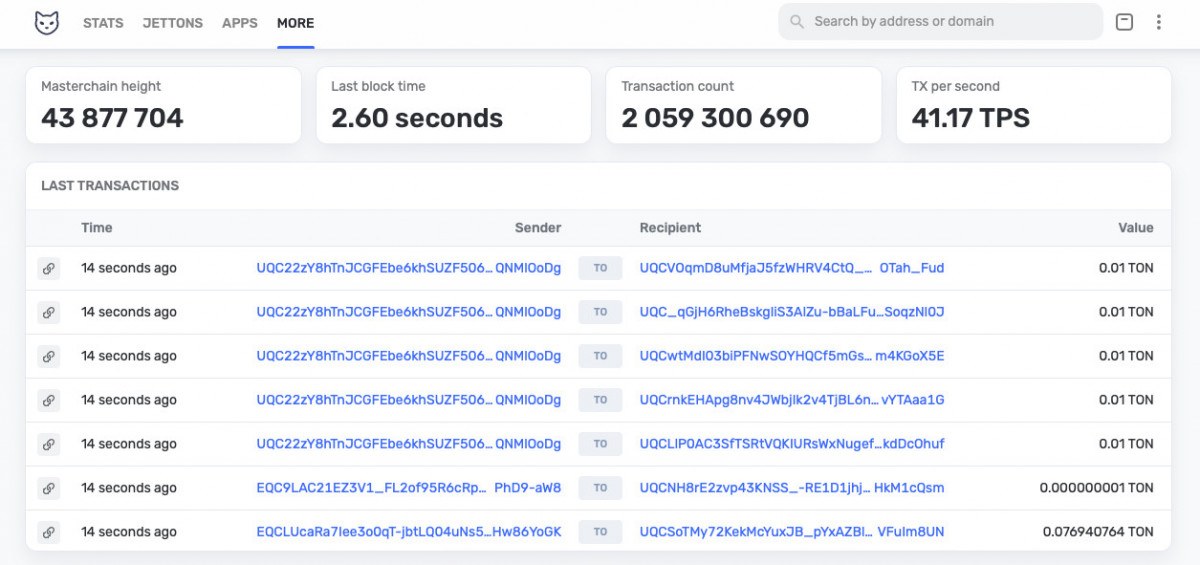

Now, let’s delve into the state of the TON community, where the TON Core team has made impressive strides by halving block generation times from 4.8 seconds to 2.8 seconds, significantly enhancing transaction speed.

Source: Tonscan

Additionally, staking yields have surged to 5.5%, up from 3.7% last summer, making TON staking an increasingly appealing option. Mixed with a notable increase in new wallet addresses, it seemed like the market was buzzing with positivity.

Source: CryptoQuant

For a brief moment, TON crossed over the $5.25 resistance, igniting hopes for a more widespread recovery.

TON/USD 1D Chart. Source: TradingView

Yet, the excitement was short-lived. Despite the technical upgrades and increasing user adoption, trading volume has seen a slight dip, and investor confidence appears tenuous. Bitcoin’s struggles have cast a long shadow over the altcoin market, including TON, which has threatened to drag it closer to the $5 support.

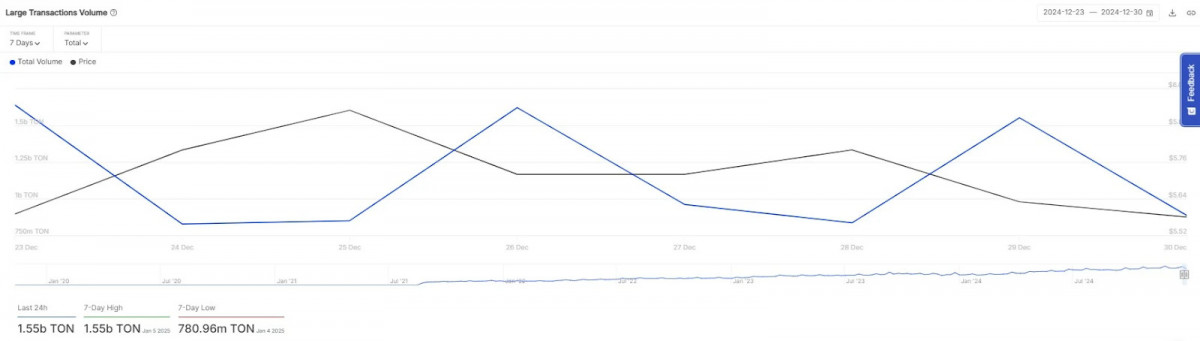

Toncoin Large Transactions. Source: CoinMarketCap

Nevertheless, whale activity has been influential in maintaining stability—1.55 billion TON (worth $8.86 billion) has moved in substantial trades, preventing the asset from sliding too drastically. Without such intervention, a more pronounced decline might have been in the cards.

TON/USD 1D Chart. Source: TradingView

However, the charts still paint a grim picture—TON continues on a solid downtrend, trading below both its 20-day and 50-day SMAs. The failure to hold the $5.50 level has compounded the pressure, with attention now shifting to the $5.00 psychological support. A breach of this level could trigger a decline to $4.75, but regaining $5.50 would signal a much-needed reversal.

TON/USD 4H Chart. Source: TradingView

The 4-hour analysis presents a glimmer of hope as the RSI approaches oversold territory, indicating that a short-term bounce could be on the horizon. However, significant hurdles remain at $5.32 and $5.50, and without timely buyer intervention, the prevailing bearish pressure is likely to drive prices lower, especially with Bitcoin's recent challenges dragging the market down. For now, maintaining the $5.00 support will be crucial for TON’s future.

Disclaimer

In line with the Trust Project guidelines Please remember that the information shared on this page is not designed to serve as legal, tax, investment, financial, or any other type of advice. It's essential to only invest what you can afford to lose and to seek guidance from a professional if you have any uncertainties. For further details, we recommend reviewing the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is dedicated to delivering accurate and impartial reporting, although market conditions are subject to sudden changes.