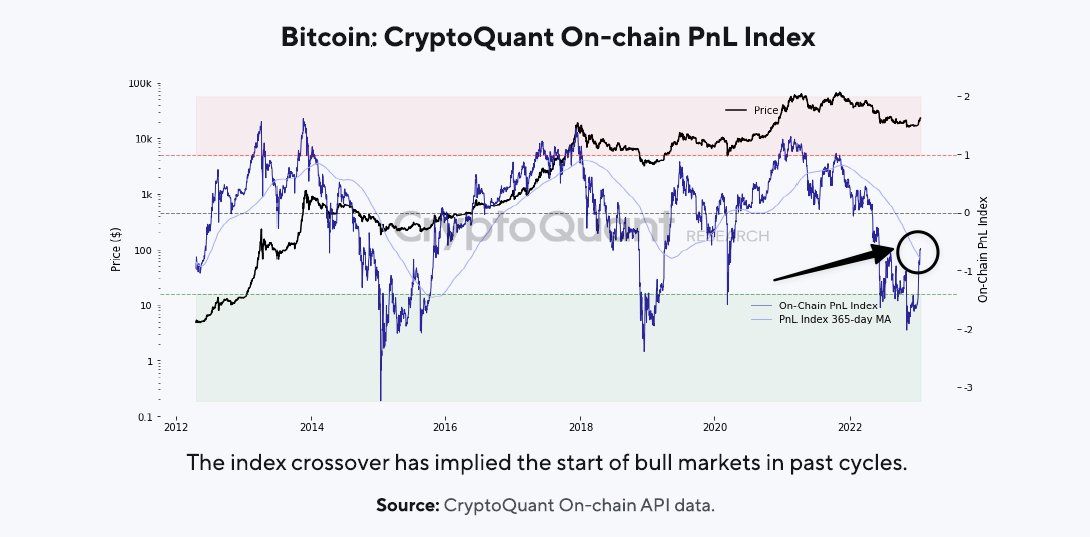

CryptoQuant's PnL Index Indicates the Onset of a Bull Market

CryptoQuant’s PnL Index clearly signals that we are in the early stages of a new bull market. By tracking retail investors’ activities, it has recently issued a strong buy indicator for BTC, which became apparent as the index crossed above its yearly moving average on May 8.

The PnL Index indicates that retail traders are primarily responsible for the recent surge in Bitcoin’s value rather than large institutional players. This uptick in retail purchasing began in early May, while institutional activity remained muted during this time.

As this bull run is still in its infancy, CryptoQuant's CEO, Ki Young Ju, is optimistic about the potential for substantial growth. He noted, \"The PnL Index highlights that retail traders are the ones propelling this price rise. Should this trend persist, we may see an even more considerable upswing.\"

It’s noteworthy that Bitcoin whales—those holding more than 1,000 BTC—have not yet shifted significant amounts to exchanges. This hesitation could act as a catalyst for the market in the near term, as these large holders are unlikely to exert selling pressure.

Despite the behavior of longer-term holders showing an uptick, there has been an increase in the transfer of coins aged between 12 and 18 months to exchanges (3,390 BTC noted on January 18). Moreover, miners contributed a substantial haul of coins (5,592 BTC on January 19). These observations point to retail players being the primary driving force behind the current price escalation, rather than whales or institutional investments. bitcoin The CryptoQuant PnL Index serves as an insightful indicator for tracking retail investor trends, clearly illustrating their influence on the current bull market. If momentum holds, we could anticipate an explosive rally soon.

In light of rising asset prices, it may be wise for savvy investors to secure a portion of their profits. This strategy enables them to lock in some gains while still enjoying benefits from potential further increases. As prices climb, it makes sense to consider taking some funds off the table to optimize returns and safeguard against potential market corrections.

CryptoQuant's PnL Index bolsters the case that we are in a bullish phase, driven by retail engagement. With major whales and institutional players remaining on the sidelines, this could be just the start of a significant upward trend. Staying informed is crucial, along with the advice to take profits when possible as the market continues to rise.

The PnL Index from CryptoQuant demonstrates that retail investors are catalyzing the current upward momentum, suggesting that we may only be scratching the surface of a larger bull market. As Bitcoin whales have yet to funnel notable amounts into exchanges, there’s a strong possibility that we’ll see another major price rally shortly.

Overall, this bullish trend appears to hold promise for the foreseeable future. With retail investors pushing asset values higher, it’s likely that institutional players will soon take an interest in the market. This shift could lead to a prolonged bull run and propel Bitcoin to new heights.

CryptoQuant’s Profit and Loss Index indicates that we are amidst a new bullish trend, driven by a surge in retail investors acquiring Bitcoin, while major whales remain on the sidelines. It's also worth mentioning that long-term holders have increased activity by moving 12-to-18-month-old coins into exchanges, further confirming that retail players are the main force behind the current price rises.

Conclusion

Disclaimer: The information provided in this article should not be construed as financial guidance. Investors should ensure thorough research is conducted before making any investment decisions. Cryptocurrency markets are highly volatile, and it’s vital for investors to grasp the risks involved.

Is there a chance for Dogecoin to make an impressive comeback after plummeting to $0.085?

Related articles:

- In recent weeks, Bitcoin (BTC) has been hovering within a narrow price corridor of around $23,400.

- Cardano is signaling early signs of an upcoming rally. Is now the right moment to think about investing?

- Please remember that the content on this page is not meant to serve as legal, tax, investment, financial advice, or any other type of guidance. Investing only what you can afford to lose is crucial, and if any uncertainty arises, seeking independent financial counsel is advisable. For more clarity, we recommend reviewing the terms and conditions along with support pages provided by the issuer or advertiser. MetaversePost is dedicated to delivering accurate and unbiased reporting, yet market dynamics can shift unexpectedly.

Disclaimer

In line with the Trust Project guidelines Moses is a seasoned freelance writer and analyst passionate about how technology reshapes finance. His extensive writings cover cryptocurrencies both from investment and technical angles, along with personal experience in cryptocurrency trading for over two years.