Crypto Weekly Highlights: Bitcoin Dips to $80K Then Rebounds, Ethereum Faces Uncertainty with ETFs, TON Benefits from the USDT Surge

In Brief

Bitcoin briefly fell below the $80K mark, only to bounce back to $93K, catalyzed by Trump’s announcement regarding a potential crypto reserve and positive ETF investments. Ethereum, on the other hand, grapples with delays in ETF approvals, while TON experiences a surge alongside USDT but is anticipating a significant token unlock.

So, that major drop we all dreaded finally occurred, pushing Bitcoin under $80K for a brief moment before it came back up like a boxer rising from a near knockout.

BTC/USD 4-Hour Chart, Source: TradingView

The rebound was significant, almost immediately reaching $93K, but then it hit a flat spot at the 50-period moving average on the 4-hour chart (refer to the screenshot). The RSI oscillated between overbought and then cooled down. So here we are in this curious space: is this merely a brief bounce, or is Bitcoin gearing up for another attempt to soar?

So what actually moved the market?

Trump’s Crypto Reserve Bombshell

This announcement was quite unexpected. Trump, yes, that same guy who once labeled Bitcoin a 'scam,' revealed that a U.S. crypto reserve could potentially include BTC, ETH, SOL, XRP, and ADA. Instantly, Bitcoin shot up like it had just downed a double espresso, pulling several altcoins along with it.

Source: Donald J. Trump

This shift liquidated a substantial number of short positions, creating a typical short squeeze phenomenon. But let's be honest—political assurances and market excitement rarely mix well. The real question remains: does this shifting narrative have any lasting implications?

ETF Flows Finally Flip Positive

For several weeks, Bitcoin spot ETFs had been struggling, leading many to doubt that institutional investors were still in the game. Then, out of nowhere, ARK 21Shares and Fidelity's Bitcoin ETFs saw net inflows totaling $369.7 million, offering some hope for the bulls.

Flows into U.S. spot Bitcoin ETFs since Feb. 18. Source: Farside Investors

Is this the beginning of a larger trend? Perhaps. However, ETF investors are notoriously unpredictable, so we should hold off on the celebratory drinks for now.

Swiss National Bank Takes a Potshot at Bitcoin

While Trump was busy touting Bitcoin's potential, the Swiss National Bank decided to dampen the mood by declaring Bitcoin too volatile as a reserve asset.

Source: Bitcoin Initiative

Considering Switzerland's reputation for conservative financial policies, this comment was not entirely surprising. Still, it did send a wave of FUD through the market. That said, it wasn’t enough to drown out Trump’s louder narrative; in the market, the loudest voice often prevails.

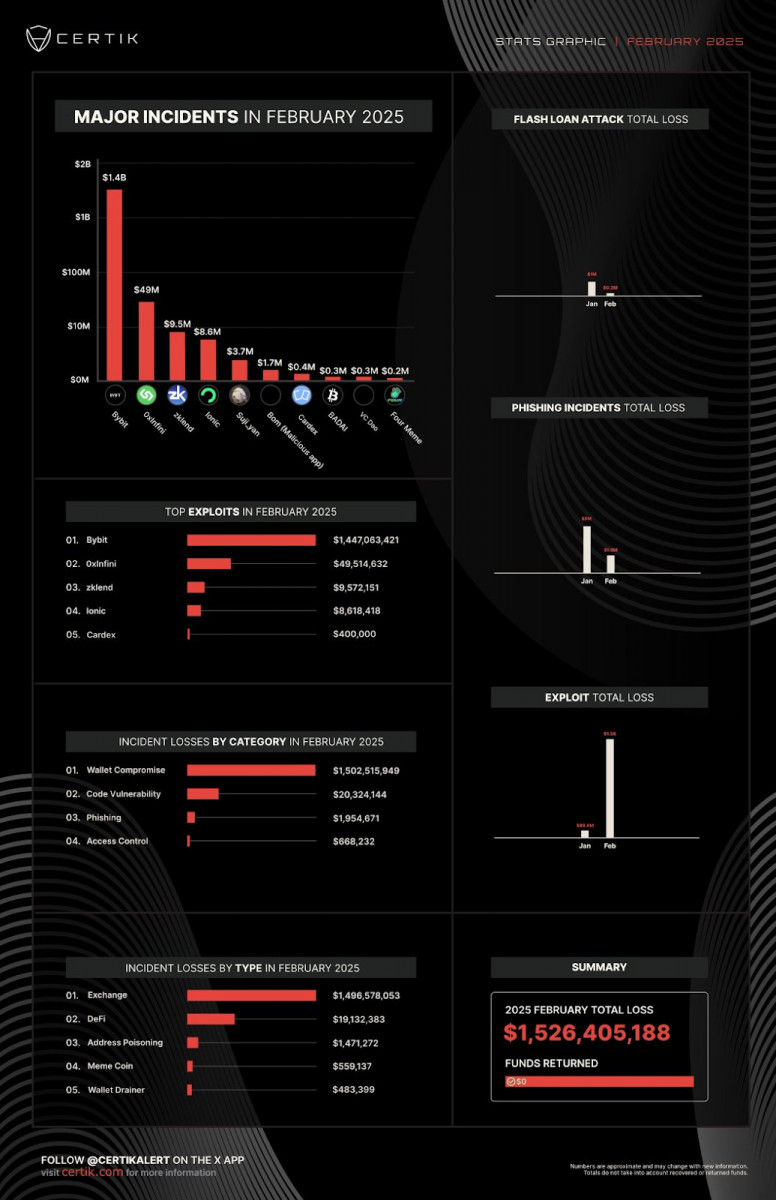

Bybit Hack: A $1.4B Disaster

As if the market needed more drama, a serious security breach at Bybit occurred, with allegations that hackers from North Korea laundered a significant amount of pilfered crypto.

Bybit faced the largest losses in February, followed by the stablecoin payment processor Infini, and the decentralized lending protocol ZkLend. Source: CertiK

This incident hit market sentiment hard, reigniting fears over exchange security. If history is any indicator, expect regulators to sharpen their tools, preparing for more stringent control.

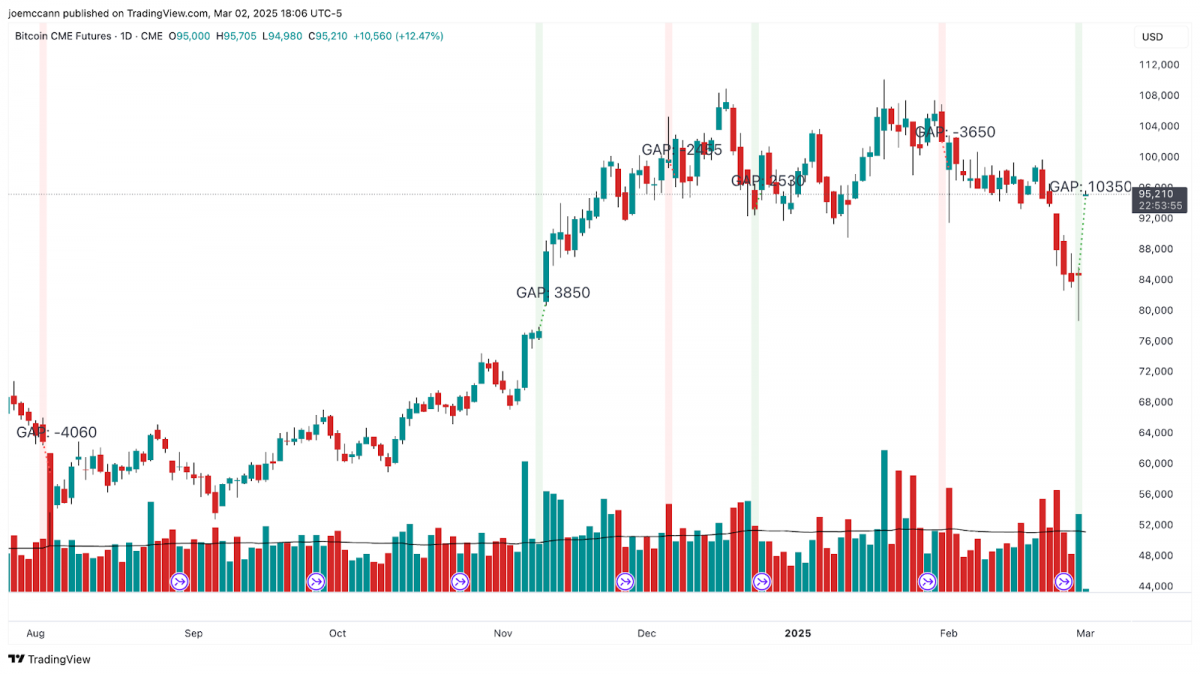

Biggest CME Gap Ever (Yep, Ever)

Here’s an interesting tidbit: a massive $10K gap just opened up in Bitcoin CME futures—the largest we’ve ever seen.

CME futures gaps. Source: Joe McCann

For seasoned traders, this isn't entirely surprising, as past patterns show that BTC typically 'fills the gap.' A retreat back towards the $83K–$85K range wouldn’t raise eyebrows, and traders are keeping a keen eye on this development.

So where does this leave Bitcoin?

Yes, Bitcoin’s bounce back was noteworthy, but let’s not sugarcoat things; we’re not out of the woods yet. The rejection at the 50-SMA is a concerning signal, and if ETF investors don’t continue to step up, another dip to around $85K could be on the horizon. Conversely, if Trump’s crypto messages sustain momentum and ETF interest grows, we might just see Bitcoin take another stab at the $95K–$100K mark. Whatever happens, expect a healthy dose of volatility.

Ethereum (ETH)

Ethereum has also seen turbulence similar to Bitcoin, plummeting from near $2,900 down into the low $2,000s before making its own recovery. It managed to briefly retake $2,500 but encountered obstacles at the 50-period moving average on the 4-hour chart (refer to the screenshot).

ETH/USD 4-Hour Chart, Source: TradingView

The RSI spiked above 60 before calming down, indicating some fatigue in the bounce. Currently sitting at $2,381, ETH is in a delicate situation, and traders are closely monitoring whether it can establish support above $2,300 or if another downward move might be imminent.

Let’s explore the latest drama surrounding Ethereum. Firstly, the Ethereum Foundation has announced a shakeup in its leadership following months of unrest within the community.

Wang on the left and Stańczak on the right. Source: The Ethereum Foundation

Whether this overhaul will spur fresh momentum or merely lead to more internal disputes remains to be seen. Meanwhile, the much-anticipated Pectra upgrade is on the horizon, promising significant advancements in scaling and mitigating MEV issues.

Source: Nic Puckrin

Regulatory ambiguity continues to cast a shadow over ETH. The SEC has once again postponed its decision regarding Ethereum ETF options, making traders anxious once again.

ETH/USD 4-Hour Chart, Source: TradingView

In the short term, Ethereum's fate remains intertwined with that of Bitcoin; however, these internal factors could lend ETH a bit of independence. If BTC can maintain stability above $90K, ETH may have another chance to inch towards $2,700 or possibly even $3K. Conversely, if Bitcoin falters—or if regulatory setbacks arise—Ethereum could slide back to around $2,100 or lower. Regardless, brace for more volatility ahead.

Toncoin (TON)

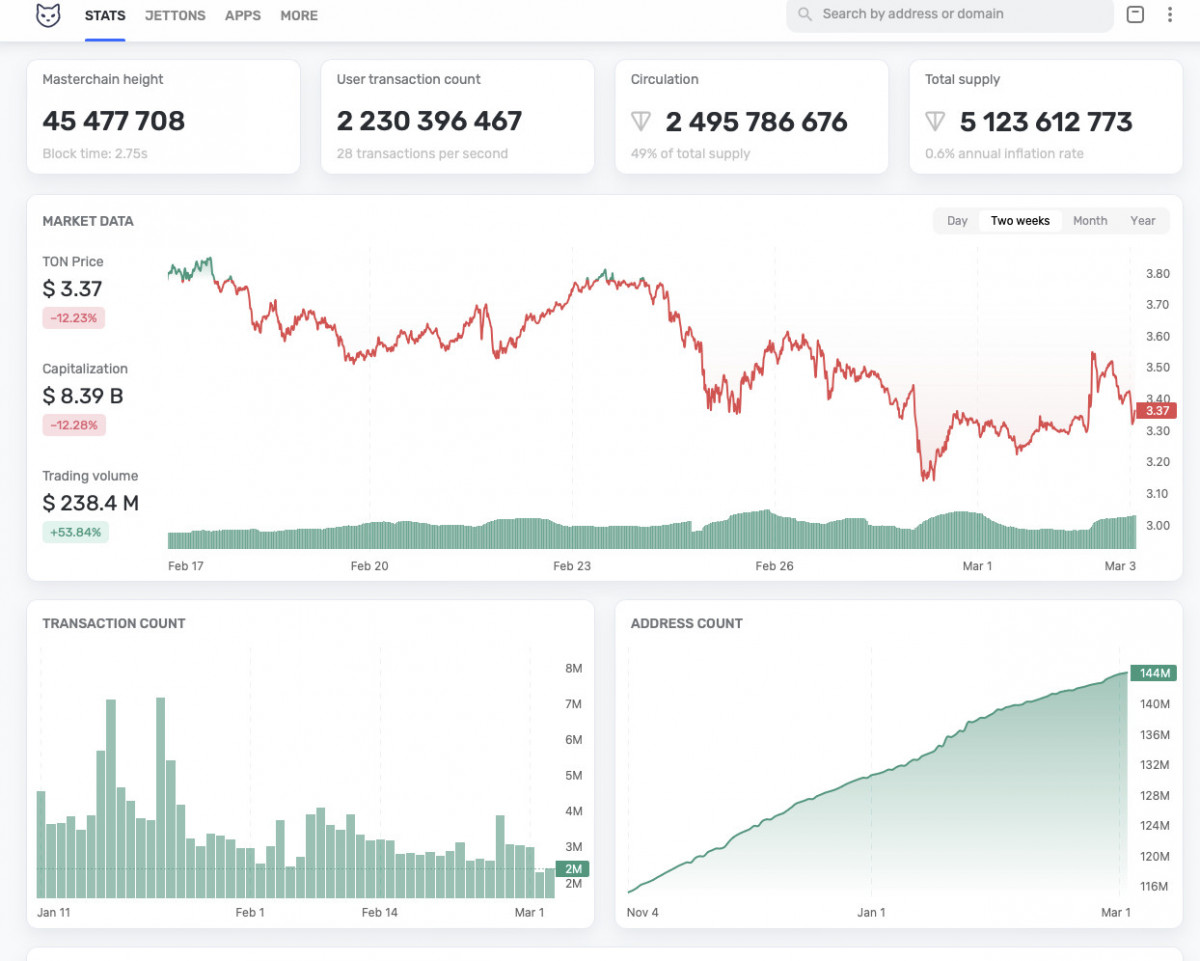

TON has been quietly making its moves, staying mostly off the radar. Sure, it dipped alongside the market, but it managed to weather the storm better than many, bouncing off the $3.10 level and surpassing $3.50 before hitting resistance at the 50-SMA (refer to the chart). The RSI is at 47.42, in a neutral space, suggesting no extreme buying or selling pressure.

TON/USD 4H Chart. Source: TradingView

One key topic is 'real' adoption. In the past 10 months, 1.5 billion USDT has been issued on the TON network, which is a significant boost for liquidity.

Source: Artemis

Increased USDT on a blockchain usually results in improved trading conditions, more extensive order books, and a robust foundation for various DeFi applications. Moreover, MyTonWallet has debuted a mini-app for Telegram, making it easier than ever to utilize TON wallets.

Source: Telegram

Then there's the upcoming token unlock on March 2, which will see 5 million TON entering the market.

Source: Tronscan

Depending on who holds these tokens and their intended actions, this could be a minor setback or a short-term annoyance. However, given TON's past strength, any price dips might just present ideal buying opportunities.

Zooming Out

In the short term, expect some volatility—it’s unavoidable. The BTC rally might decelerate, and TON’s upcoming unlock could stir the pot further. Yet, on a broader scale, the crypto landscape is once again dominating mainstream discussions, and whether we love or loathe him, Trump's next headline is likely to stir the market once more.

Disclaimer

In line with the Trust Project guidelines , please be aware that the information provided on this page does not constitute and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It’s crucial to invest only what you can afford to lose and to seek independent financial guidance if you have any uncertainties. For further details, we recommend checking the terms and conditions along with the help and support sections available from the issuer or advertiser. MetaversePost is dedicated to delivering accurate and impartial information, but market conditions may change without warning.