Crypto Market Summary: Bitcoin Holds Steady Below $100K, Ethereum Experiences Short Selling, TON Remains Resilient

In Brief

The fluctuations in Bitcoin's value are heightened due to ETF withdrawals and the overarching economic climate, even as institutional giants like Goldman Sachs and Tesla reaffirm their commitment to BTC. Ethereum is struggling in comparison, but TON's price holds steady.

Bitcoin (BTC)

Back again, Bitcoin has found itself hovering in a narrow range between $95K and $98K over the past week, hinting at potential breakouts but never quite achieving them. So, what's causing this stagnation for BTC? Let's dive in.

BTC/USD 4H Analysis, Coinbase. Source: TradingView

Starting with the ETF outflows, an impressive $651 million exited from Bitcoin ETFs, making it another challenging week for institutional capital flow. Yet, Bitcoin enthusiasts, often called whales, continued to accumulate, preventing the market from falling deeper.

Bitcoin held in wallets with 0.1 to 1 BTC. Source: Glassnode

The macroeconomic environment isn't doing Bitcoin any favors either. Recent CPI and PPI reports revealed hotter-than-anticipated numbers, leaving traders anxious. The Federal Reserve seems unlikely to lower rates anytime soon—bad news for risk assets such as Bitcoin.

Bill SB21. Source: Capitol.texas.gov

Regulatory discussions are back on the table. Several U.S. states, Texas included, have introduced Bitcoin reserve bills, indicating that state-level adoption is gaining traction. Meanwhile, the SEC has once again delayed decisions on various ETF applications, leaving investors in uncertainty.

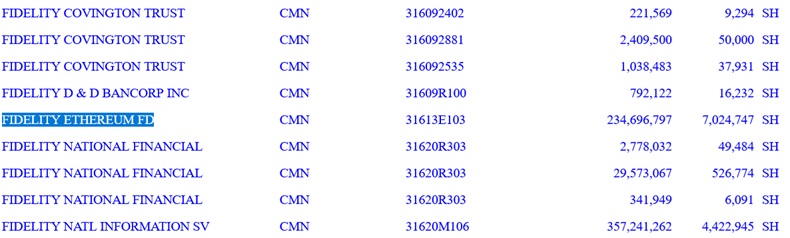

Goldman’s 13F filing reveals $234.7 million in Fidelity’s Ethereum ETF. Source: SEC

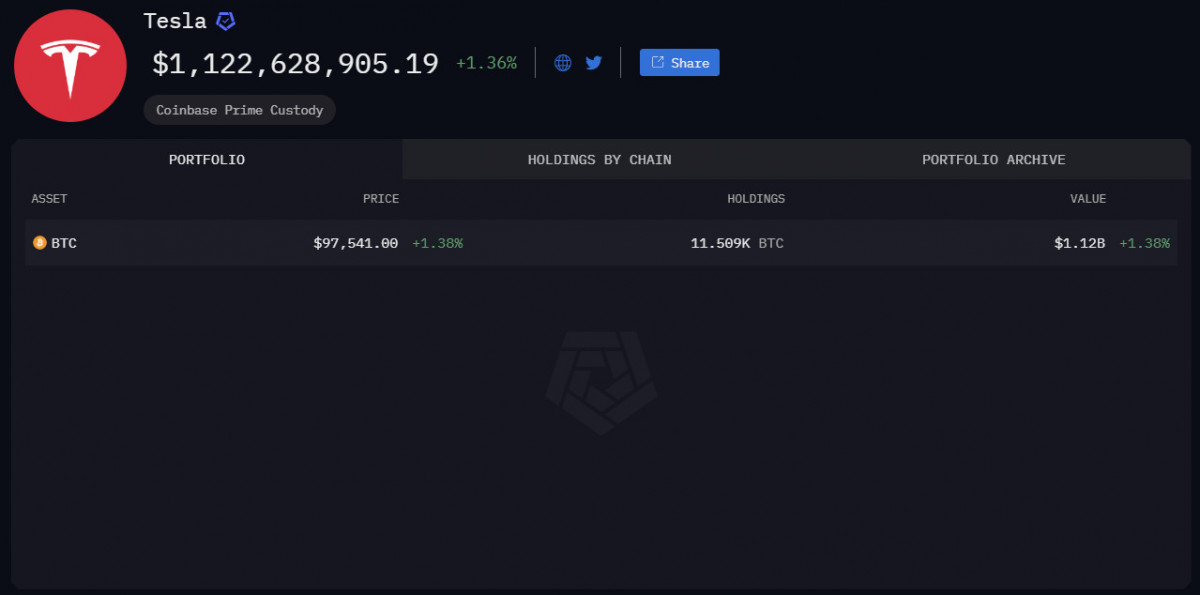

Talking about institutional players, even though ETF outflows are happening, heavyweights aren’t fleeing the scene. Goldman Sachs has ramped up its Bitcoin ETF stake to $1.5 billion, while Tesla confirmed BTC's importance in its quarterly report—definitely a turnaround for an asset that Wall Street once considered a fleeting trend. Also, MicroStrategy (now simplified to just 'Strategy') is persistently increasing its BTC stash, and GameStop recently experienced an 18% stock bounce fueled by rumors of a potential Bitcoin initiative.

Tesla's total Bitcoin valuation. Source: Arkham Intelligence

On-chain, we’re seeing signs of a classic supply squeeze. Bitcoin exchange reserves hit a three-year low (2.5M BTC), meaning fewer coins are available for immediate sale. If demand picks up, well… you know what happens next.

Bitcoin reserves across all exchanges. Source: CryptoQuant

Price-wise, it's still uncertainty.

BTC/USD 4H Analysis, Coinbase. Source: TradingView

Looking at the 4-hour chart, Ethereum's price has bounced between different support and resistance levels without gaining real traction. The 50-period SMA (orange line) is currently acting as resistance, preventing upward movement, and with the RSI sitting at 40.71—below neutral—there's a noticeable softness in bullish attempts. If sellers gain ground, we could see Bitcoin revisit levels around $95K or even $93K. Conversely, if it breaks the 50-SMA and surpasses $98.5K, a march toward $100K could be back in sight.

Ethereum (ETH)

Ethereum hasn’t had the best of weeks either. It’s been fluctuating between $2,600 and $2,800 while experiencing pressure from a wave of short positions.

ETH/USD 4H Analysis, Coinbase. Source: TradingView

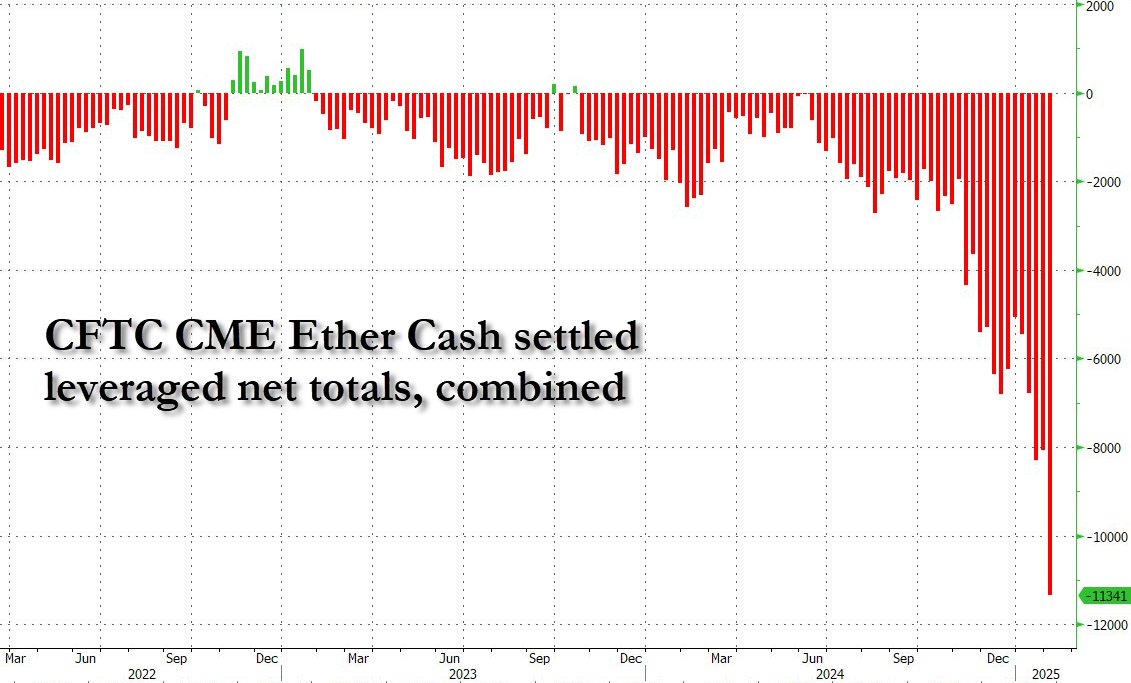

The notable trend among hedge funds is their aggressive shorting of Ethereum, with positions surging by 500%. This represents a hefty short-term bet against ETH's performance, and it currently seems to be effective.

Ether cash-settled leveraged net short figures. Source: Zerohedge

However, it's not all doom and gloom. The NYSE has taken steps to allow staking for Grayscale's spot Ether ETF, which could draw in fresh corporate interest.

NYSE suggests amendments to the Grayscale Ethereum Trust ETF and Grayscale Mini Trust ETF for staking. Source: NYSE

On another positive note, the Ethereum Foundation allocated $120 million into DeFi initiatives, reinforcing ETH's dominant position within the decentralized finance landscape. Additionally, in what seems to be a rare win for traders, Ethereum's gas fees fell below $1 million for the first time since September 2024, indicating reduced network congestion.

Source: Ethereum Foundation

True to form, Ethereum developers have remained busy, choosing to accelerate the deployment schedule for upcoming hard forks to keep Ethereum competitive. Nonetheless, despite these enhancements, the short-sellers maintain their advantage, and Ethereum needs stronger momentum to break free from its current hold.

ETH/USD 4H Analysis, Coinbase. Source: TradingView

Currently, Ethereum is caught in a range-bound consolidation phase between $2,500 and $2,800, mirroring Bitcoin's unclear trajectory. The 50-period SMA (orange line) at $2,673 is proving to be a crucial pivot point, with ETH fluctuating around this figure without generating significant momentum.

With the 4-hour RSI sitting at 48.82, just under the neutral mark of 50, there’s a conspicuous absence of strong buying or selling pressure. Presently, ETH appears to be in a holding pattern, awaiting a catalyst—whether it’s a Bitcoin breakout, a rise in stablecoin demand, or more dApps stemming from the new migration initiative.

If ETH manages to break above the $2,800 mark, it could pave the way for a move towards the $3,000 resistance level. Conversely, should sellers take command and push ETH below $2,500, a decline to the lower support levels around $2,350 to $2,400 could be on the horizon. For the moment, ETH is adopting a cautious wait-and-see approach.

Toncoin (TON)

While TON may not have shown significant price movement, it has been busy developing its network. For instance, it has now integrated with Tether's USDt ecosystem through LayerZero, connecting it with Ethereum, Tron, Solana, and nine other blockchains—an important move for improved liquidity and interoperability.

Source: the TON blog

TON's ambitions go beyond DeFi; it's making strides in the dApp sector. The introduction of the TON Mini App Migration Grant aims to entice developers from other platforms to transition their mini-apps to TON. If this initiative picks up steam, TON could carve out a significant niche in the Web3 application space.

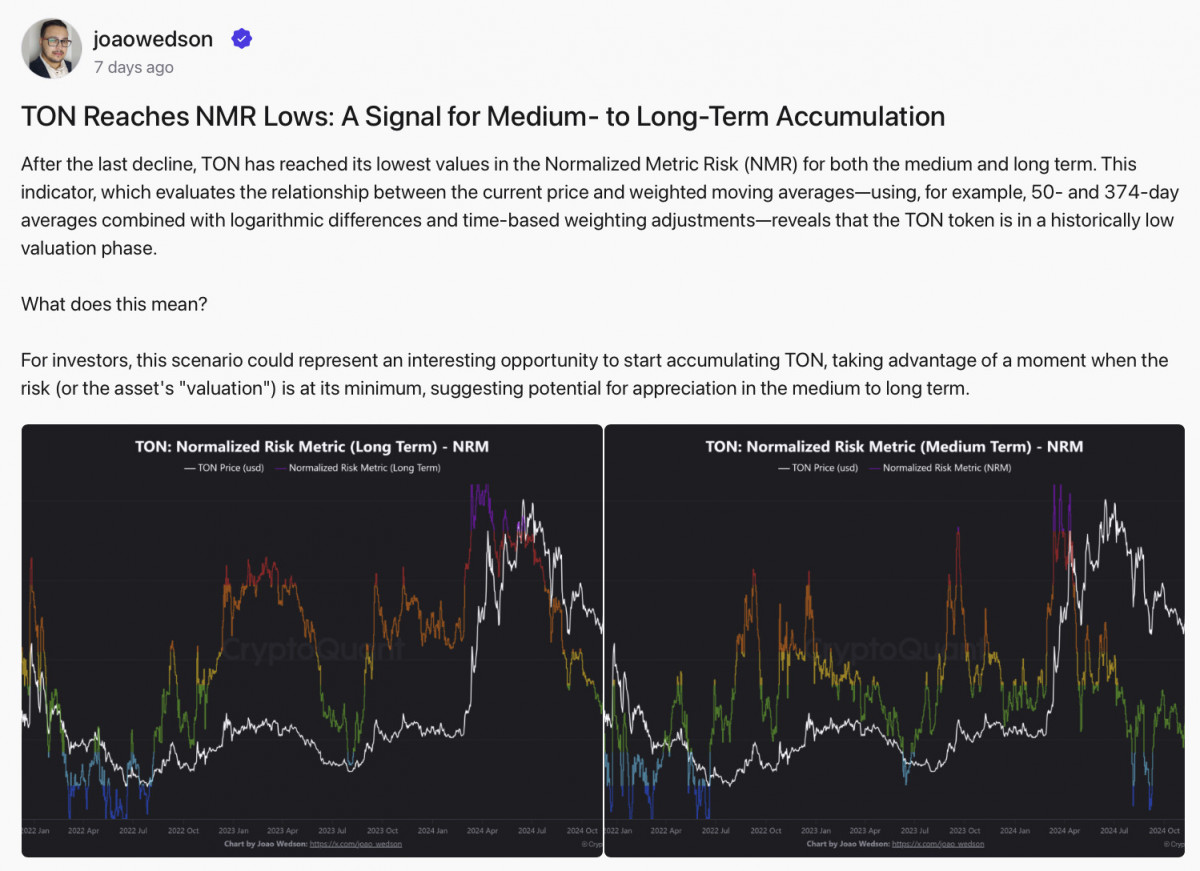

From an investment standpoint, analysts at CryptoQuant have identified TON as significantly oversold, with their NMR indicator suggesting historical accumulation points. This indicates they see it as a strong entry opportunity for medium to long-term investors.

Source: CryptoQuant

Despite all the action surrounding it, TON's price has remained quite stable within the $3.60 to $3.90 range. Unlike Bitcoin and Ethereum, which have experienced fluctuations, TON's price has stabilized, lingering just above the 50-period SMA at $3.78.

TON/USD 4H Chart. Source: TradingView

The RSI for TON is tracked at 48.41, indicating a lack of intense buying or selling activity. At present, TON seems to be in a waiting phase, searching for a catalyst—this could come from a Bitcoin breakthrough, increased stablecoin activity, or a surge in dApps thanks to the new migration program.

If TON can surpass the $3.90 mark, it may begin to target a climb toward $4.20 and beyond. Conversely, if bearish sentiment prevails and it drops below $3.60, the next support level to watch would be around $3.40. For the moment, TON is setting itself up favorably for the long term, though it requires patience from traders.

Disclaimer

In line with the Trust Project guidelines Please be aware that the details shared on this platform are not intended to serve as legal, tax, investment, or financial advice. It's essential to only invest what you can afford to lose and to consult independent financial experts if you have uncertainties. For additional information, we recommend checking the provided terms and conditions, as well as the support and help resources from the issuer or advertiser. MetaversePost aims to deliver precise, impartial reporting, but market conditions can change at any time without prior notice.