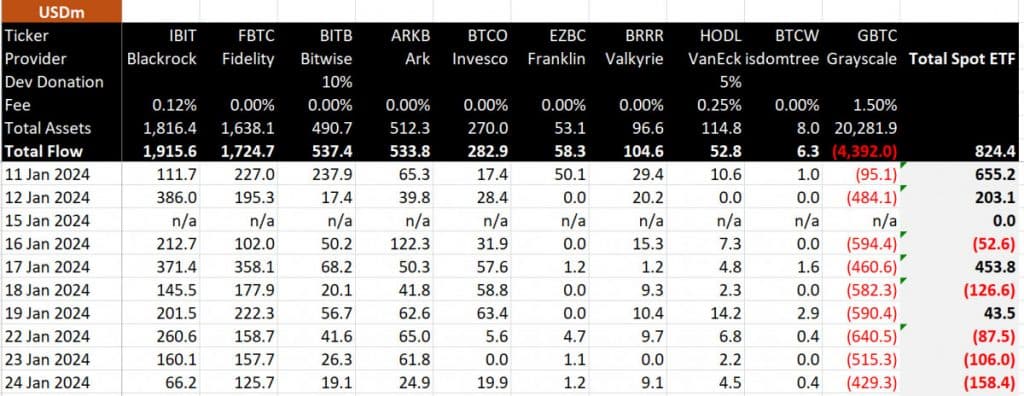

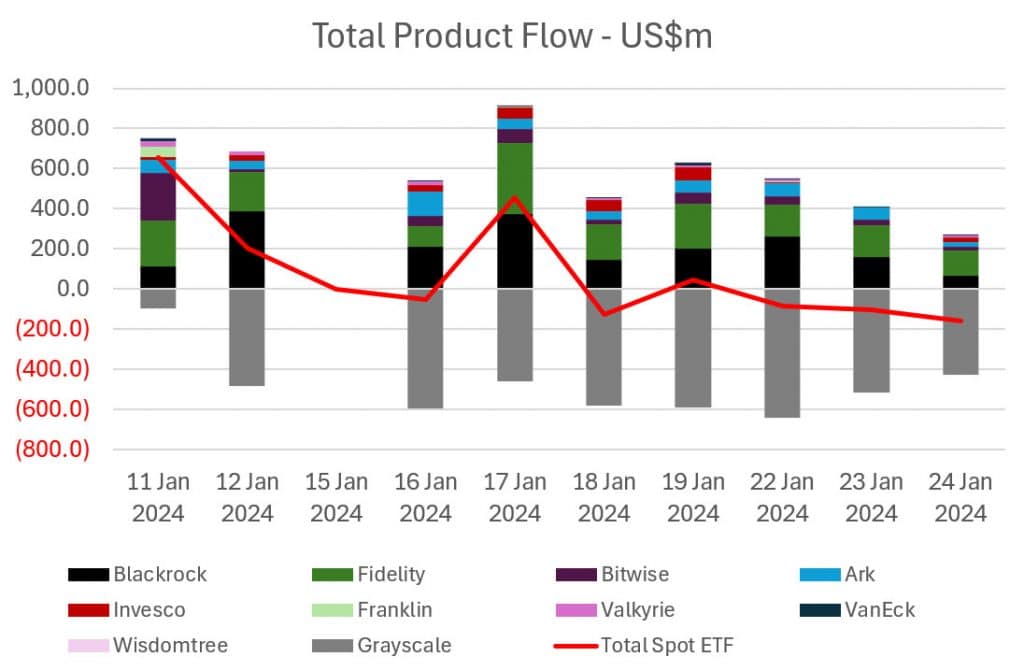

Bitcoin spot ETFs encountered a net outflow of $158 million on the ninth day, while the Grayscale Bitcoin Trust ETF experienced withdrawals totaling $429 million.

In Brief

The findings indicate that on day nine, Bitcoin spot ETFs faced a notable outflow of $158 million, alongside significant withdrawals from the Grayscale Bitcoin Trust ETF amounting to $429 million.

On the 9th day, the Bitcoin spot ETF During this period, a minor performance increase of $66 million was observed, but Fidelity significantly outshone with an uplifting gain of $126 million. BlackRock As this nine-day period concludes, BlackRock is firmly ahead in the competition, having amassed a whopping total flow of +$1,916 million. Closely behind is another firm with +$537 million.

In terms of Bitcoin accumulation after nine days, BlackRock holds the prime position with +45,594 BTC, followed by Fidelity with +41,007 BTC. Fidelity at +$1,725 million, and Bitwise Securing third place is Ark with +12,685 BTC, just ahead of Bitwise, which has +12,354 BTC.

The Grayscale Bitcoin Trust ETF continues to face challenges in the market.

Despite its transition to an ETF and receiving approval from the U.S. Securities and Exchange Commission (SEC), Grayscale Investments' Bitcoin Trust is still struggling with net outflows. Analysts have observed a decrease in the fund’s significant asset lead compared to its competitors. Nevertheless, many believe that it might not relinquish its title as the largest spot Bitcoin ETF just yet.

Since officially becoming an ETF on January 11, the Grayscale Bitcoin Trust ETF has seen significant net withdrawals. Just recently, it noted $515 million in outflows, bringing the cumulative total close to $4 billion. By Wednesday afternoon, the assets under GBTC's management were approximately $21 billion. Grayscale fund The offerings from BlackRock and Fidelity have consistently attracted net inflows, pushing their asset totals to around $1.85 billion and $1.6 billion, respectively.

A notable factor in the recent outflow trend from the Grayscale Bitcoin Trust has been a significant sell-off, with one entity divesting 22 million shares from GBTC, valuing nearly $1 billion. GBTC Some market analysts foresaw GBTC’s net outflows due to its 1.5% management fee, which, despite being lowered from 2% post-ETF conversion, still remains relatively high when compared to rivals whose fees fluctuate between 0.19% to 0.39%.

In contrast, competing Bitcoin ETFs \"The considerable outflow from Grayscale’s GBTC fund has added to the decline in its status. Investors who previously bought into GBTC at a marked discount to NAV in anticipation of its ETF conversion are now exiting the Bitcoin space altogether rather than switching to more budget-friendly spot Bitcoin ETFs,\" explained Nikolaos Panigirtzoglou, Managing Director at a leading financial firm.

FTX For your awareness, the information presented here is not to be seen as legal, tax, investment, financial, or any other kind of advice. It's important to invest only what you can afford to lose and to seek independent financial guidance if uncertainties arise. For more details, we recommend reviewing the terms and conditions along with the support resources offered by the respective issuer or advertiser. MetaversePost is dedicated to providing accurate and unbiased reporting, yet market conditions may change without prior notice.

Victor serves as a Managing Tech Editor/Writer at Metaverse Post, where he covers diverse topics such as artificial intelligence, cryptocurrency, data science, the metaverse, and cybersecurity within corporate frameworks. With a media and AI background spanning five years, he has contributed to reputable outlets like VentureBeat, DatatechVibe, and Analytics India Magazine. As a Media Mentor at distinguished universities including Oxford and USC, and holding a Master's degree in data science and analytics, Victor is dedicated to staying on top of the latest trends.

He brings readers the freshest and most thought-provoking stories from the Tech and Web3 arena. J.P. Morgan .

Disclaimer

In line with the Trust Project guidelines Vanilla is shaking things up by rolling out 10,000x leverage super perpetuals on the BNB Chain.